tl;dr: 75% of $UST is held in Anchor because of its high fixed yield. When the yield drops, in order for $UST to hold its peg, there need to be organic use cases for $UST. I propose a Terra EVM (Terranova) in addition to some novel DeFi infrastructure below.

History will view algorithmic stablecoins as either a) a disaster as inevitable as the subprime mortgage crisis or b) the greatest recent innovation in financial history.

In this post, I will give an economic analysis of Terra's $UST, leading to concrete recommendations for the Terra ecosystem.

A Brief History of Terra

If you're already familiar with Terra, you can skip this section.

Context for the uninitiated: $UST is the largest algorithmic stablecoin, with other examples being Beanstalk and Basis (rest in peace). Much of the draw to $UST is because of the high fixed yield available to $UST holders via Anchor Protocol, Terra's lending platform: if you leave your money in $UST for one year, Anchor will guarantee 20% APY. And this isn't 20% of imaginary Monopoly money, because $UST is pegged to the US dollar.

So what's the problem? Well, some people say that 20% can't last forever. Anchor is only able to afford paying out that 20% yield by loaning out $UST, but if they aren't able to make the 20% through cash flows, then it comes from their reserve - which is being depleted. Eventually, the Anchor Protocol will not be able to provide this 20% APY. Recently, Anchor adopted a proposal for a dynamic rate, which will gracefully reduce the APY.

When the APY drops, people might sell their $UST. This is a big deal, since about 75% of all $UST is locked in Anchor! While Terra will attempt to maintain the $UST peg by minting $LUNA, this great article by @damsondao explains the risk of a death spiral:

"UST redemptions in favor of LUNA that is being sold on the market by arbitrageurs leads to a significant decrease in its price, which necessitates more LUNA being minted for each UST burned, creating a hyper-inflationary loop in LUNA's supply. This then trigger [sic] a crisis of confidence in LUNA's ability to retain value that further reduces demand for UST until the mechanism implodes as it fails to adequately reduce supply and UST's peg inevitably breaks."

It leads to the question: How can we incentivize people to hold their $UST once the Anchor yields decline? (We can ask the same question about $LUNA, since it is used to stabilize $UST. A simplified explanation is that when $UST falls below peg, the system issues $LUNA and buys back $UST until it re-pegs. When $UST rises above peg, the system sells $UST and burns the $LUNA.)

Make Something People Want

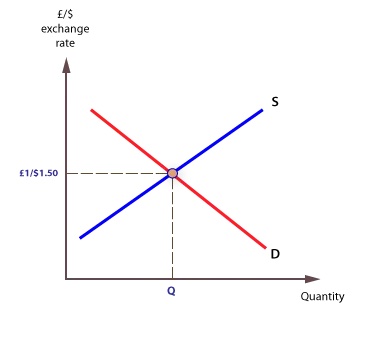

A natural starting point is to ask how the US dollar does it. It all comes down to supply and demand:

At any given "price" for dollars, some people decide to continue holding dollars. The US dollar must provide sufficient incentives for people to hold this currency over all others, or else the currency will lower in "price" (depreciate).

Moreover, the US dollar must be especially good at incentivizing people to hold, since it qualifies as a coupon coin. While the Federal Reserve can temporarily decrease the money supply by selling securities through open market operations, eventually the principal must be repaid in addition to any interest, so the money supply only increases in the long run. So the supply curve in the diagram above is continually shifting right, and yet the dollar doesn't have a depreciation crisis.

In fact, the US does such a good job incentivizing us to hold $USD that most of us don't even think about whether we're going to trade our dollars for some other currency. The primary reason to hold the US dollar is because we use it in our day-to-day life: to receive our paychecks, to pay for our groceries, to buy our stocks.

Which leads me to this tweet by Do Kwon:

8/ New algo stablecoin developers need to remember that their challenge is economy building > mech design.

— Do Kwon 🌕 (@stablekwon) June 18, 2021

The only way to stability sustainable use cases around the stablecoins, and stability will increase as these use cases become more sticky, distributed and uncorrelated.

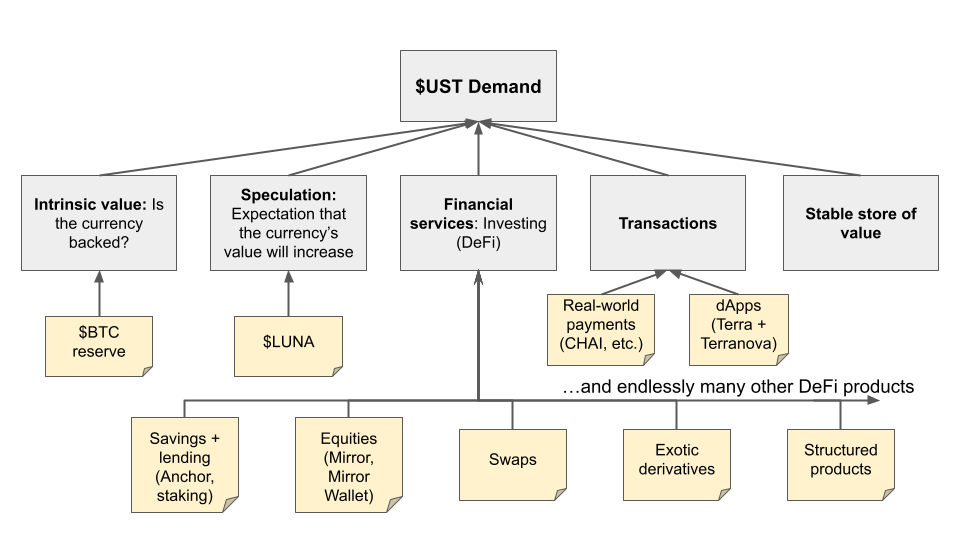

How can we think about the sources of demand for a currency? Here is a (very incomplete) framework:

In the diagram above, the recently-introduced Bitcoin reserve increases the intrinsic value of $UST. While the Anchor yields will decline over time, as more protocols launch on Terra, we'll see staking yields climb.

The Terra DeFi Ecosystem Must Grow

Recommendations:

1. EVM compatibility

Composability drives network effects: the more that is built on Terra, the stickier it becomes.

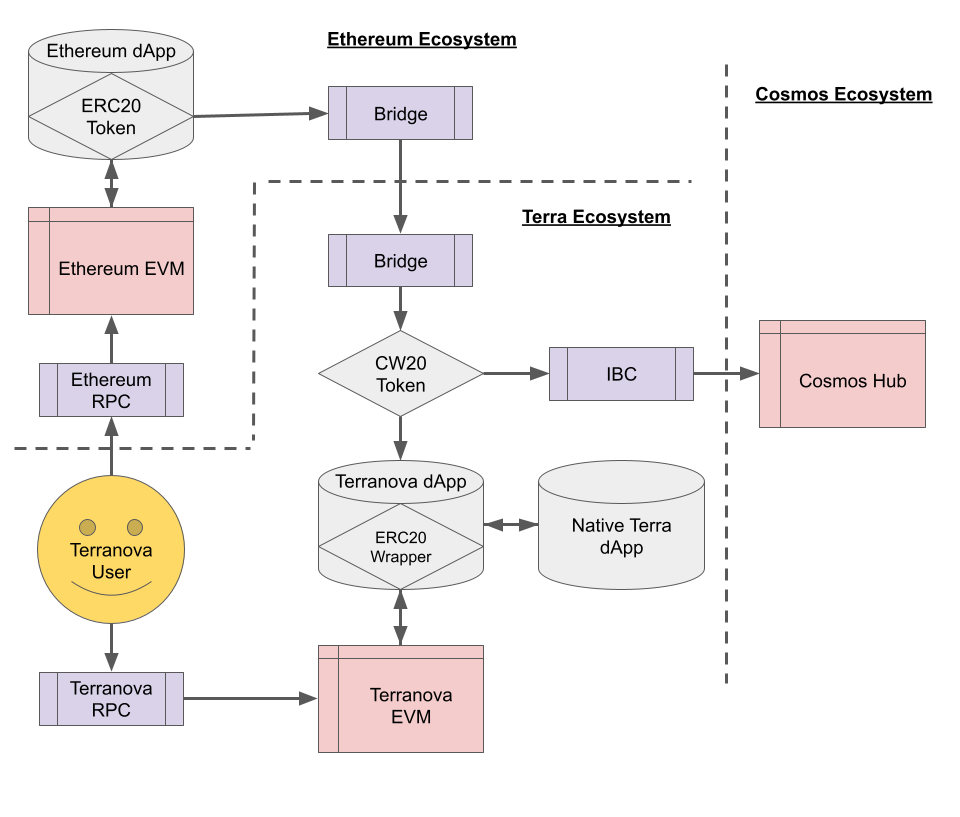

In summer 2021, Binance Smart Chain usage exploded with a variety of applications that resembled popular Ethereum dApps: SushiSwap vs. UniSwap, Ellipsis vs. Curve, etc. This is why I'm building Terranova: an Ethereum Virtual Machine (EVM) on Terra.

EVM compatibility on Terra will win for several reasons. In a multichain future, EVM compatible L1s will capture the growing transaction volume and mitigate Ethereum network congestion. Terra becomes a contender as the dominant EVM compatible chain in the Cosmos ecosystem (cf. Evmos). Ethereum dApps will interoperate easily with Terra dApps through native "cross chain messaging" between Terranova and Terra, giving access to yields through Anchor, synthetics through Mirror, etc. And Ethereum dApps will unlock more use cases for $UST.

An EVM on Terra brings the top Ethereum dApps (e.g., money markets, option protocols, DEXes) to Terra and empowers developers who are already familiar with Ethereum tooling. Terra gains access to the tremendous amount of liquidity on EVM compatible chains, since it's possible some percent of that liquidity is unfamiliar with non-EVM compatible chains. If you are interested in working on this problem, email me at neeljaysomani [at] gmail.com.

2. Build novel DeFi infrastructure

I see Terra as a high-potential contender to have the most sophisticated DeFi infrastructure in crypto, creating network effects that both usher in and retain institutional capital.

Some novel areas we should explore:

- A wider variety of oracles: Given my background as a quant in power pricing, some oracles that are interesting to me involve the weather, power prices, and gas prices. Such oracles would enable institutional investors to participate in popular commodities trading devices, such as heat rate call options, spark spreads, and weather options. The large institutional electricity trading market is a great fit for trading on the blockchain because crypto is becoming increasingly relevant for power traders anyway. For example, Talen Energy (owner of coal plant Brandon Shores) recently announced a Bitcoin mining venture.

- More sophisticated financial instruments: First we had Mirror for synthetics, soon we'll have Sigma for options. Next we should develop futures and forwards on Terra. These would likely rely on oracles like those described above. By combining forwards on the price of Bitcoin and the electricity price, a Bitcoin miner can hedge out their price exposure. In addition, Terra's native stablecoins are perfect for constructing derivatives like currency swaps.

What's next?

We're about to witness the outcome of a groundbreaking experiment in DeFi. $UST's success depends on whether we can collectively build the necessary network effects to prevent it from collapsing. I'm actively building a Terra EVM to support the ecosystem and would love to talk with others who are interested in working on some of the related problems. I'm curious to hear the Terra community's thoughts, so let me know what you think on Twitter (@neelsalami, @TerranovaEVM) or at neeljaysomani [at] gmail.com.